Illinois Sales Tax Tangible Personal Property . illinois’ tax system pertaining to the sale and use of tangible personal property codifies four separate taxes: illinois’ sales tax is a combination of four taxes, all of which are imposed on sales of tangible personal property to end users—the. retailers’ occupation and use taxes apply when tangible personal property is sold at retail to be used or consumed in illinois. the state sales tax rate is 6.25% on sales of tangible personal property other than sales of some food (generally grocery food items),. In illinois, occupation and use taxes are collectively referred to as “sales tax.” the retailers’ occupation tax act imposes a. a remote retailer selling tangible personal property at retail in illinois is subject to state and local sales tax if either of the following. illinois requires that sales tax is charged and collected by a “retailer,” which is a business engaged in the business of selling.

from www.formsbank.com

illinois’ sales tax is a combination of four taxes, all of which are imposed on sales of tangible personal property to end users—the. illinois’ tax system pertaining to the sale and use of tangible personal property codifies four separate taxes: illinois requires that sales tax is charged and collected by a “retailer,” which is a business engaged in the business of selling. the state sales tax rate is 6.25% on sales of tangible personal property other than sales of some food (generally grocery food items),. retailers’ occupation and use taxes apply when tangible personal property is sold at retail to be used or consumed in illinois. a remote retailer selling tangible personal property at retail in illinois is subject to state and local sales tax if either of the following. In illinois, occupation and use taxes are collectively referred to as “sales tax.” the retailers’ occupation tax act imposes a.

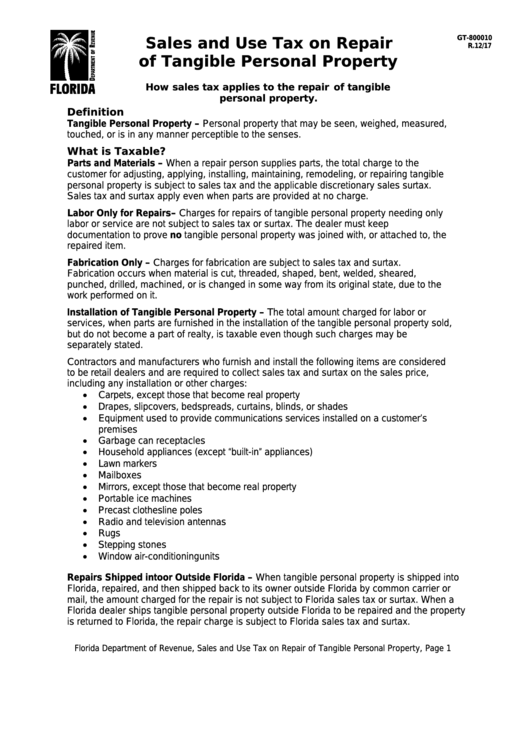

Form Gt800010 Sales And Use Tax On Repair Of Tangible Personal

Illinois Sales Tax Tangible Personal Property retailers’ occupation and use taxes apply when tangible personal property is sold at retail to be used or consumed in illinois. illinois requires that sales tax is charged and collected by a “retailer,” which is a business engaged in the business of selling. a remote retailer selling tangible personal property at retail in illinois is subject to state and local sales tax if either of the following. the state sales tax rate is 6.25% on sales of tangible personal property other than sales of some food (generally grocery food items),. retailers’ occupation and use taxes apply when tangible personal property is sold at retail to be used or consumed in illinois. illinois’ tax system pertaining to the sale and use of tangible personal property codifies four separate taxes: In illinois, occupation and use taxes are collectively referred to as “sales tax.” the retailers’ occupation tax act imposes a. illinois’ sales tax is a combination of four taxes, all of which are imposed on sales of tangible personal property to end users—the.

From studylib.net

Disposition of Tangible Personal Property Illinois Sales Tax Tangible Personal Property retailers’ occupation and use taxes apply when tangible personal property is sold at retail to be used or consumed in illinois. In illinois, occupation and use taxes are collectively referred to as “sales tax.” the retailers’ occupation tax act imposes a. a remote retailer selling tangible personal property at retail in illinois is subject to state and local. Illinois Sales Tax Tangible Personal Property.

From dxofdyyse.blob.core.windows.net

What Is Tangible Personal Property Tax Return at Bernadine Campbell blog Illinois Sales Tax Tangible Personal Property In illinois, occupation and use taxes are collectively referred to as “sales tax.” the retailers’ occupation tax act imposes a. retailers’ occupation and use taxes apply when tangible personal property is sold at retail to be used or consumed in illinois. illinois’ sales tax is a combination of four taxes, all of which are imposed on sales of. Illinois Sales Tax Tangible Personal Property.

From www.formsbank.com

Tangible Personal Property Tax Return printable pdf download Illinois Sales Tax Tangible Personal Property the state sales tax rate is 6.25% on sales of tangible personal property other than sales of some food (generally grocery food items),. In illinois, occupation and use taxes are collectively referred to as “sales tax.” the retailers’ occupation tax act imposes a. illinois’ tax system pertaining to the sale and use of tangible personal property codifies four. Illinois Sales Tax Tangible Personal Property.

From www.formsbank.com

Form Gt800038 Sales And Use Tax On Tangible Personal Property Illinois Sales Tax Tangible Personal Property In illinois, occupation and use taxes are collectively referred to as “sales tax.” the retailers’ occupation tax act imposes a. illinois’ tax system pertaining to the sale and use of tangible personal property codifies four separate taxes: illinois’ sales tax is a combination of four taxes, all of which are imposed on sales of tangible personal property to. Illinois Sales Tax Tangible Personal Property.

From taxfoundation.org

Tangible Personal Property State Tangible Personal Property Taxes Illinois Sales Tax Tangible Personal Property retailers’ occupation and use taxes apply when tangible personal property is sold at retail to be used or consumed in illinois. the state sales tax rate is 6.25% on sales of tangible personal property other than sales of some food (generally grocery food items),. illinois requires that sales tax is charged and collected by a “retailer,” which. Illinois Sales Tax Tangible Personal Property.

From www.taxuni.com

Illinois Sales Tax Illinois Sales Tax Tangible Personal Property illinois requires that sales tax is charged and collected by a “retailer,” which is a business engaged in the business of selling. retailers’ occupation and use taxes apply when tangible personal property is sold at retail to be used or consumed in illinois. In illinois, occupation and use taxes are collectively referred to as “sales tax.” the retailers’. Illinois Sales Tax Tangible Personal Property.

From www.mnfamilylawblog.com

101 Tangible Personal Property Lists Brown Law Offices Illinois Sales Tax Tangible Personal Property illinois’ sales tax is a combination of four taxes, all of which are imposed on sales of tangible personal property to end users—the. retailers’ occupation and use taxes apply when tangible personal property is sold at retail to be used or consumed in illinois. illinois’ tax system pertaining to the sale and use of tangible personal property. Illinois Sales Tax Tangible Personal Property.

From efiletaxonline.com

Treatment of Tangible Personal Property Taxes by State, 2024 Illinois Sales Tax Tangible Personal Property the state sales tax rate is 6.25% on sales of tangible personal property other than sales of some food (generally grocery food items),. In illinois, occupation and use taxes are collectively referred to as “sales tax.” the retailers’ occupation tax act imposes a. illinois’ tax system pertaining to the sale and use of tangible personal property codifies four. Illinois Sales Tax Tangible Personal Property.

From taxfoundation.org

Tangible Personal Property State Tangible Personal Property Taxes Illinois Sales Tax Tangible Personal Property the state sales tax rate is 6.25% on sales of tangible personal property other than sales of some food (generally grocery food items),. illinois’ tax system pertaining to the sale and use of tangible personal property codifies four separate taxes: retailers’ occupation and use taxes apply when tangible personal property is sold at retail to be used. Illinois Sales Tax Tangible Personal Property.

From wshlawyers.com

What is a Tangible Personal Property List and What Are The Benefits Illinois Sales Tax Tangible Personal Property illinois’ sales tax is a combination of four taxes, all of which are imposed on sales of tangible personal property to end users—the. illinois requires that sales tax is charged and collected by a “retailer,” which is a business engaged in the business of selling. In illinois, occupation and use taxes are collectively referred to as “sales tax.”. Illinois Sales Tax Tangible Personal Property.

From www.formsbank.com

2013 Tangible Personal Property Tax Return printable pdf download Illinois Sales Tax Tangible Personal Property retailers’ occupation and use taxes apply when tangible personal property is sold at retail to be used or consumed in illinois. illinois’ tax system pertaining to the sale and use of tangible personal property codifies four separate taxes: illinois requires that sales tax is charged and collected by a “retailer,” which is a business engaged in the. Illinois Sales Tax Tangible Personal Property.

From www.keysnews.com

NOTICE SAM STEELE, MONROE COUNTY TAX COLLECTOR, ANNOUNCES THE OPENING Illinois Sales Tax Tangible Personal Property illinois’ tax system pertaining to the sale and use of tangible personal property codifies four separate taxes: a remote retailer selling tangible personal property at retail in illinois is subject to state and local sales tax if either of the following. retailers’ occupation and use taxes apply when tangible personal property is sold at retail to be. Illinois Sales Tax Tangible Personal Property.

From accotax.co.uk

Tangible Personal Property Definition and Example Accotax Illinois Sales Tax Tangible Personal Property illinois requires that sales tax is charged and collected by a “retailer,” which is a business engaged in the business of selling. a remote retailer selling tangible personal property at retail in illinois is subject to state and local sales tax if either of the following. illinois’ sales tax is a combination of four taxes, all of. Illinois Sales Tax Tangible Personal Property.

From dxolsfeet.blob.core.windows.net

Vehicle Sales Tax Il at Joshua Smith blog Illinois Sales Tax Tangible Personal Property retailers’ occupation and use taxes apply when tangible personal property is sold at retail to be used or consumed in illinois. illinois’ sales tax is a combination of four taxes, all of which are imposed on sales of tangible personal property to end users—the. illinois requires that sales tax is charged and collected by a “retailer,” which. Illinois Sales Tax Tangible Personal Property.

From www.youtube.com

What is Tangible Personal Property? Sales Tax Shorts YouTube Illinois Sales Tax Tangible Personal Property illinois’ sales tax is a combination of four taxes, all of which are imposed on sales of tangible personal property to end users—the. retailers’ occupation and use taxes apply when tangible personal property is sold at retail to be used or consumed in illinois. the state sales tax rate is 6.25% on sales of tangible personal property. Illinois Sales Tax Tangible Personal Property.

From www.bmcestateplanning.com

Tangible Personal Property What Is It and the Role It Plays in Your Illinois Sales Tax Tangible Personal Property retailers’ occupation and use taxes apply when tangible personal property is sold at retail to be used or consumed in illinois. illinois requires that sales tax is charged and collected by a “retailer,” which is a business engaged in the business of selling. the state sales tax rate is 6.25% on sales of tangible personal property other. Illinois Sales Tax Tangible Personal Property.

From www.pdffiller.com

State Tangible Personal Property Taxes Doc Template pdfFiller Illinois Sales Tax Tangible Personal Property In illinois, occupation and use taxes are collectively referred to as “sales tax.” the retailers’ occupation tax act imposes a. illinois’ sales tax is a combination of four taxes, all of which are imposed on sales of tangible personal property to end users—the. illinois’ tax system pertaining to the sale and use of tangible personal property codifies four. Illinois Sales Tax Tangible Personal Property.

From taxfoundation.org

Tangible Personal Property State Tangible Personal Property Taxes Illinois Sales Tax Tangible Personal Property retailers’ occupation and use taxes apply when tangible personal property is sold at retail to be used or consumed in illinois. illinois requires that sales tax is charged and collected by a “retailer,” which is a business engaged in the business of selling. illinois’ tax system pertaining to the sale and use of tangible personal property codifies. Illinois Sales Tax Tangible Personal Property.